Our approach

DH2 energy integrates the complex bricks of the value chain (upstream, midstream, downstream, financing) to deliver mass- scale green hydrogen at fossil fuel parity, now.

The company acts both as the organizer of a value chain platform (HyDeal Ambition) and as an integrated industrial player (hydrogen production and supply)

Project development

and management

System design

and engineering

Investment

and financial structuring

Customer solution

Green hydrogen projects require to integrate the complete value chain, just as in the oil and gas industry. DH2 energy operates across the value chain though upstream, midstream, downstream and financial partnerships, to guarantee the delivery of competitive green hydrogen to its clients

Upstream

Production

DH2 energy develops its own projects and teams up with other solar developers and electrolyzer manufacturers to produce hydrogen at fossil fuel parity. This implies mass-scale developments (GW) and the joint location of power generation and electrolysis, where power is cheapest and water available, and the smart integration of value chain players. DH2 energy focuses on Southern Europe and North Africa.

Downstream

Off-take and usage

DH2 energy designs customer solutions to serve green hydrogen users in industry (chemicals, steel, cement), energy (co-generation, gas-to-power) and mobility (cars, trucks, trains, shipping), providing a reliable and economic alternative to oil, natural gas and coal.

Midstream

Transmission and storage

It is essential to match generation and consumption, which can be significantly away from each other, with users expecting reliable delivery at very low cost. DH2 collaborates with natural gas transmission operators which aim at ensuring the sustainability of their business by converting portions of their grids to methane/hydrogen blending or pure hydrogen.

Financing

DH2 energy collaborates with banks and equity investors to design the most bankable contract structures with a view to lower risks and maximize value creation. DH2 energy is working with major financial institutions in a spirit of long-term partnership.

A unique value proposition...

Upstream

Energy ressource

Hundreds of GWs of competitive solar projects are ready for construction in Southern Europe and North Africa.

Midstream

Transmission and storage infrastructure

Thousand of kilometers of gas transmission and TWh of salt caverns are ready for conversion to hydrogen (blending and pure hydrogen).

Downstream

Demand for

zero-carbon energy

Energy users throughout Europe are clamoring for zero-carbon, reliable, competitive energy.

Financing

Zero-carbon investment

Investors and banks are anxious to protect to shield their investments from carbon risk.

The pathway to fossil-fuel parity :

super competitive solar and electrolyzer gigafactories

- The global solar PV market is expected to reach 209 GWin 2021 (x3in5 years) representing two thirds of net global power capacity additions

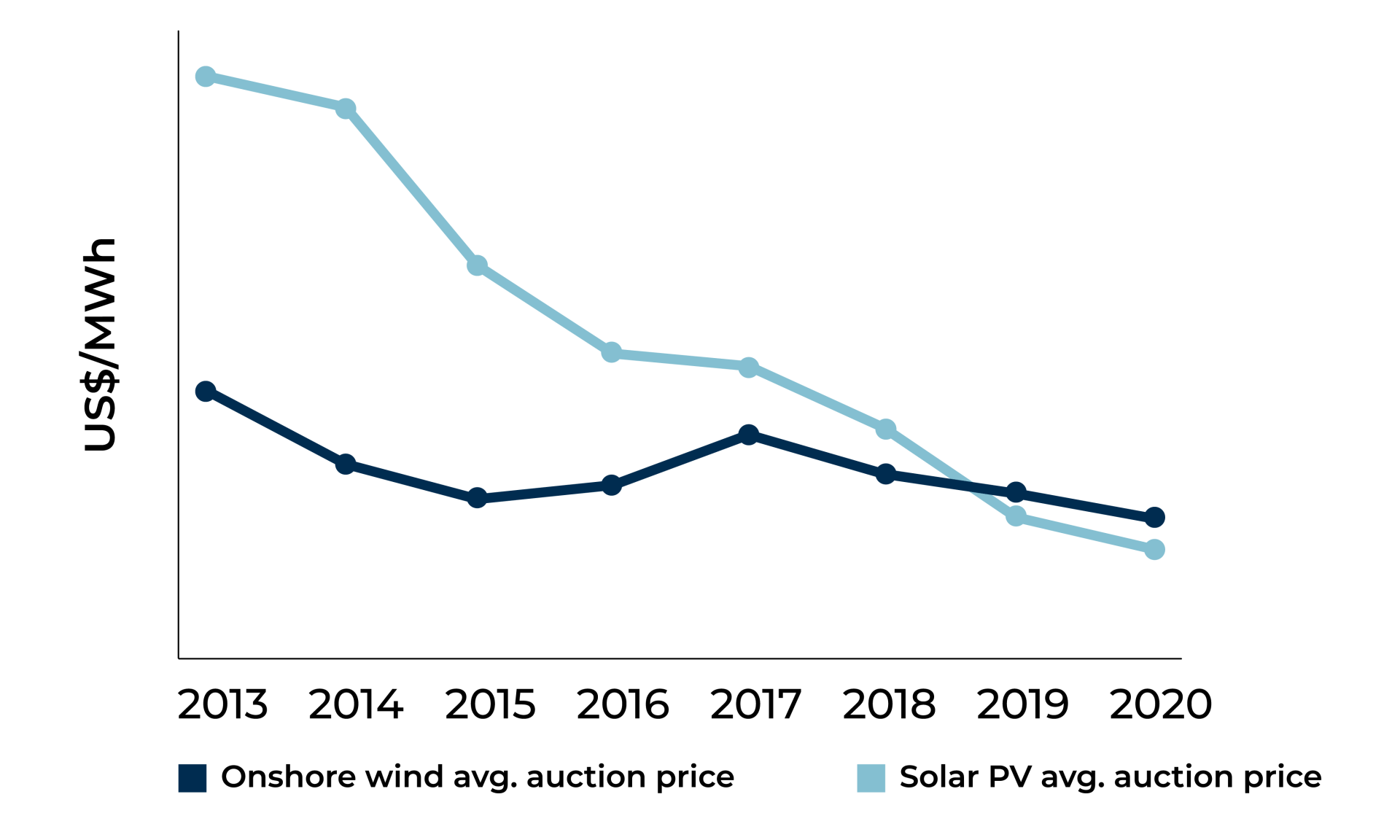

- Worldwide solar PV average auction price was around 30 €/MWh in 2020 and levels as low as 11 €/MWh were seen in auctions in Southern Europe

- Cell efficiencies (hetero junction and tandem cells) are expected leap from 20% to 30% in the next decade, and prices lower than 7 €/MWh by 2030 are likely to be achieved in high-irradiation areas

- With these efficiencies and at that price level, solar PV is likely to stamp out competition from other power sources

- Only 1% of the area of South Europe and North Africa would be sufficient to substitute 100% of Europe’s fossil fuel consumption

- Electrolyzer manufacturers are ramping up gigafactories to match skyrocketing demand

- Gigafactories will generate massive efficiencies in technology (larger stacks) and efficiencies

- Alkaline technology is flexible (load following of variable power generation, cost efficient, scalable, modular, mature and bankable

- Cost are expected to fall by 60% by 2025

- The usage of water is very reasonable: converting Europe’s entire fossil fuel consumption to green hydrogen would increase water consumption by amere 1.7%